Hedgehog Ninja and ADR Scale these are tools for MT5 with the help of which, according to the developer, he passes the FTMO! Some guys write to me to i share materials for MT5 as well, so I will do it from time to time, but now let’s get acquainted with the tools in more detail below.

Attention !!! Please read carefully the rules for installing the advisor, and install it correctly. Before publishing, we check everything and publish only those advisors that work on our accounts !!! At least at the time of this article’s publication.Also, please note that the name of the adviser has been changed, you can find the original name of the adviser in our telegram channel https://t.me/FX_VIP/1965

| Developer price | Hedge Ninja |

| Terminal | MT5 |

| Currency pair | Currency, Index, Cryptocurrency |

| Timeframe | Any |

| Money management | Any |

| Recommended brokers | RoboForex, IC Markets, ALPARI |

| For advisor recommended to use VPS 24/5 | Zomro (most affordable Windows server only $ 2.75 per month) |

Hedgehog Ninja

WIN NO MATTER IN WHICH DIRECTION THE PRICE MOVES

This robot wins no matter in which direction the price moves by following changing direction depending on in which direction price moves. This is the most free way of trading to this date.

So you win no matter which direction it moves (when price moves to either of the red lines as seen on the screenshot, it wins with the profit target you have set up).

The only risk you have is if price is consolidating (stays in one place).

Hedgehog Ninja is a semi-automatic trading tool that you setup with the hedge settings below. When you tell it to trade, either buy or sell it then handles everything for you.

Every time the robot changes direction, it will cover up for your previous losses, so when you reach either of the red lines, your profit will be what you decided it to be.

Important note! This robot’s usage is best-used intraday when the spread is normal. You shall avoid market roll-over at all costs because if you have many open positions and you reach market rollover or a big news event it can fail big time due to high spread.

If you think it’s hard to determine in which direction the market will go, this robot changes the direction in which the price moves so you win no matter which direction the price moves. The downside of this strategy is when the price consolidates for too long.

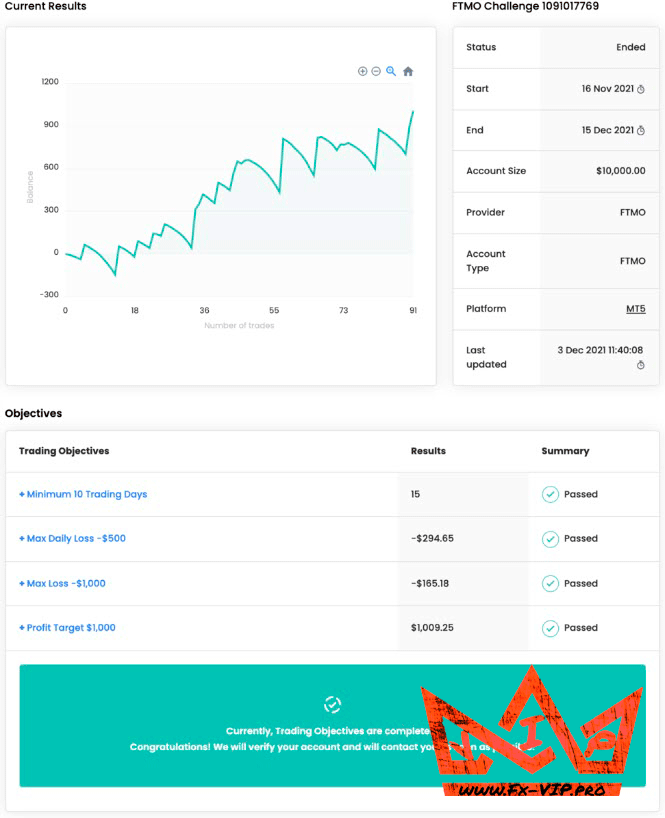

The developer claims that with the help of this it easily passes the FTMO test, below the link you can get acquainted with the monitoring in more detail

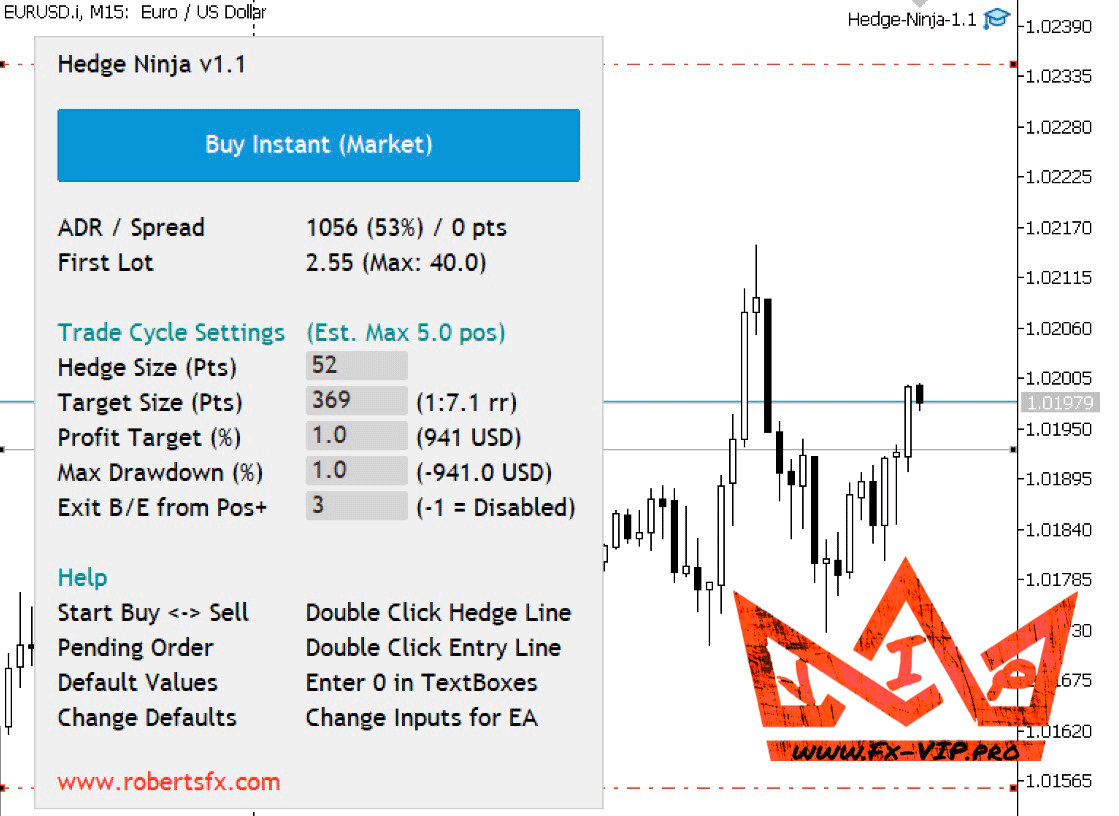

The trade panel

Highly customizable trade panel where you decide on how you want your setup to be. Drag the red lines to your desired target or enter manually. When the price moves to either of the red dashed lines, you will close in profit.

The blue line means it will begin with a buy, the gray line below is the hedge zone, when the price reaches that price it automatically calculates the needed lot size to reach your desired target at the closest red line.

Key Features

Strategy

A hedging strategy that makes it win no matter which direction the price moves. As long as the price moves, it wins. The risk with this strategy is consolidation areas. So combined with some manual analysis in areas where you know the price will most likely move away, it can do amazing results.

Manual or Automatic

Choose if you want to tell it when to enter, and in which start direction, or do full automatic. I’m using it for instance as buy only on Nasdaq100 (us100) between hours 15:00 – 16:00 CET when New York opens and the price most likely move a lot.

Take Profit

You decide at which price you shall hit your target, both above entry, and below entry. The EA calculates needed lot sizes to reach your target approximately at your desired prices.

Drawdown Limit

You can set how much drawdown is allowed before closing the trade cycle.

Compounding

Trade volume (lot size) is based on account balance so automatically as your account grows, the trade volume increases so you benefit from compounding.

Entry

Enter directly in either buy or sell or place a pending order at the desired location.

Full Strategy

Settings

ADR / Avg Spread

The ADR is the average daily range showing how many pts this instrument normally moves in a day, on average. This is good to know because you do not want this robot to run over market rollovers where the spread gets a lot higher.

So if ADR is 500 pts, you should try to keep your target points lower than this, more like half your ADR. It’s great to combine Hedge Ninja with ADR Scalping indicator.

First Lot / Next Lot

Show your first/next trades lot size. This one calculates real-time so between entry and until you reach the hedge price this will change.

Trade cycle settings

A trade cycle is all your combined hedge trades together. So each cycle aims to open one or more positions, counted together as one unit, and when all trades in that cycle are in total profit or drawdown that you decided, it will close all trades.

Hedge Size (Pts)

This is your hedge distance is before the EA changes the direction of your trade. This could be seen as your stop loss for each position.

Target Size (Pts)

This is how many points away from your entry and hedge your target (take profit) should be. It’s not exact but the EA calculates lot sizes the best it can to have your target reach desired price levels.

If you trade intraday, a tip is to have these within the ADR high and low.

Profit Target (%)

This is how much you want to profit in percent of your account equity when the price reaches any of your target lines, both upper and lower.

Max Drawdown (%)

How many % are you allowed to use for your hedge trades before it closes everything in loss?

Exit B/E from Pos+

Set a number from where the EA will close the trade at breakeven if possible. If you enter 3, it will close the trade as soon as it reaches breakeven. This is good if you want to reduce your risk after a certain amount of positions and start over with another trade.

Important note! Allow webrequest url – https://api.robertsfx.com

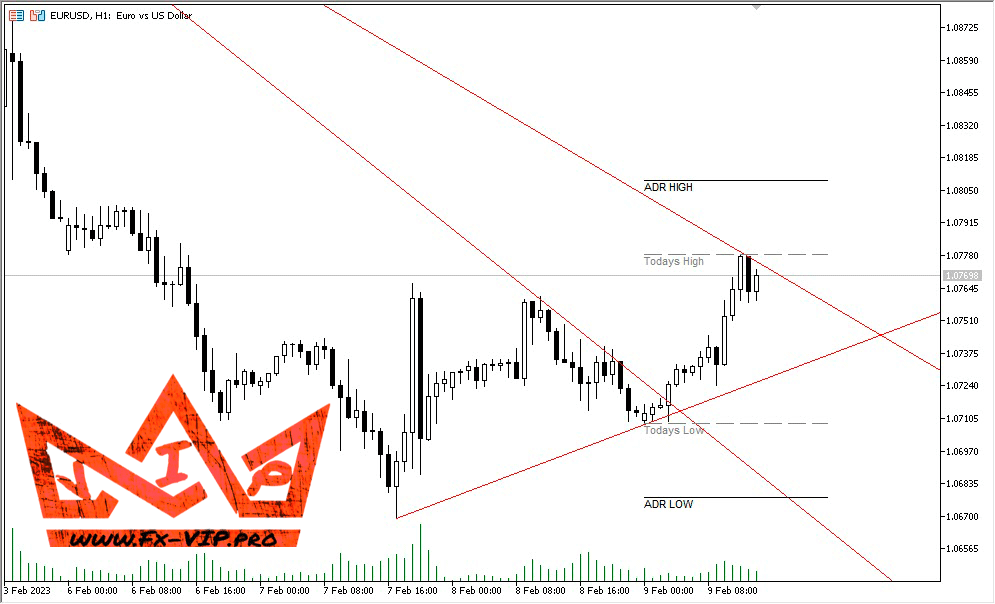

ADR Scale Indicator

This is easilly the most overlooked indicator that gives you most insights in price action. This indicator gives you insights on how much price will move today, and in which direction most likely.

ADR stands for average daily range. If you trade or scalp intraday, you must know the range of how much price will move.

Let’s say price has moved half of what is normal for the day, and it’s in the bottom of price action, it is more likely that price continues to move down, rather than moving ALL the way up again to reach the average daily range. Price always seeks to move for the average daily range.

You will also be given dynamic support and resistance. When price has moved as much as the average range, you can trade towards the middle.

This indicator will also let you know if price is likely to bounce from a trendline or not. So if you like to trade using trendlines, this is the indicator for you!

Video how to work on the indicator

Conclusion:

I have not yet fully understood how it all works, but I think if you have free time, then you should study and watch the video carefully, maybe you will find something interesting for yourself and you can interpret it in your trading, regarding the indicator ADR he based on the ATR , you should take a closer look at it, and whoever doesn’t know what it is, I recommend studying everything about the ATR in more detail, since indicators based on the ATR are really worthy of attention and help the trader in trading, there is a lot of information on the ATR for forex trading on the Internet, so don’t be lazy study gain experience all this will undoubtedly help you for profit trading in the future!

Reminder: As with every trading system, always remember that forex trading can be risky. Don’t trade with money that you can not afford to lose. It is always best to test EA’s first on demo accounts, or live accounts running low lotsize. You can always increase risk later!

AJ

17/04/23

am using mt5 platform

does it work for

AJ

17/04/23

Hello chef.

No library to install for this expert?

I tried to use it as is, it opens but doesn’t fit in the chart . Not work

andy

29/03/23

does not run in new version of mt5

Pedro

10/02/23

Hello chef. No library to install for this expert? I tried to use it as is, it opens but doesn’t fit in the chart

Fx-VIP.pro team

15/02/23

It works without dll

DKRIMX

09/02/23

Thank you for this one. Don’t forget to use EMA 5 and 7 or 9 and 13 to see the sideway market. Sometime I use 5 and 13 to check the cross over or movement of the market.

Pedro

09/02/23

Hello chef.

No library to install for this expert?

I tried to use it as is, it opens but doesn’t fit in the chart . Not work