For successful trading in the Forex market, it is important to be able to correctly find the end and start points of a trend , as well as accurately determine the future direction of price movement. For these purposes, traders use various tools, ranging from classic support / resistance levels to more complex and paid indicators. One of such algorithms is the Explosive Reversal Indicator. This tool was developed specifically for identifying trend reversal points.

Attention !!! Please read carefully the rules for installing the advisor, and install it correctly. Before publishing, we check everything and publish only those advisors that work on our accounts !!! At least at the time of this article’s publication.Also, please note that the name of the adviser has been changed, you can find the original name of the adviser in our telegram channel https://t.me/Fx_VIP

| Developer price | |

| Terminal | MT4 |

| Currency pair | Any |

| Timeframe | H1, H4 and D1 |

| Recommended brokers | ALPARI, IC Markets |

DESCRIPTION OF THE ALGORITHM

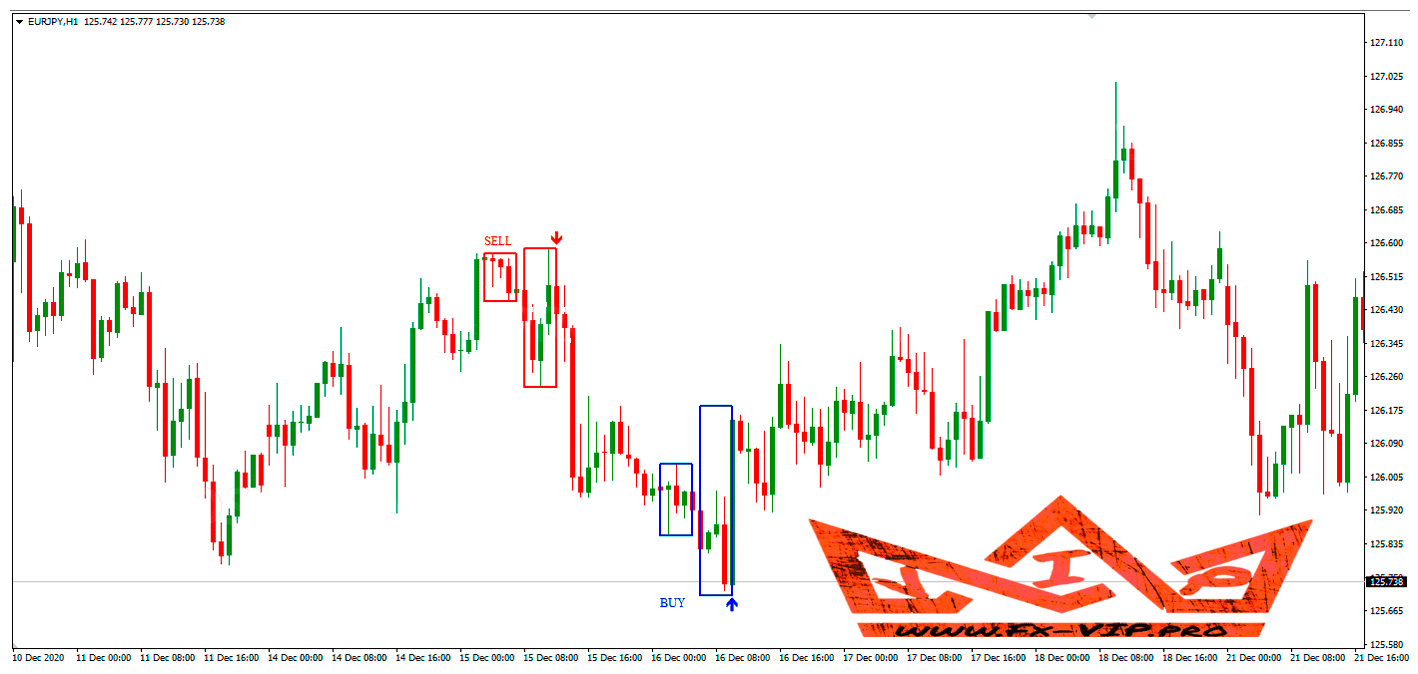

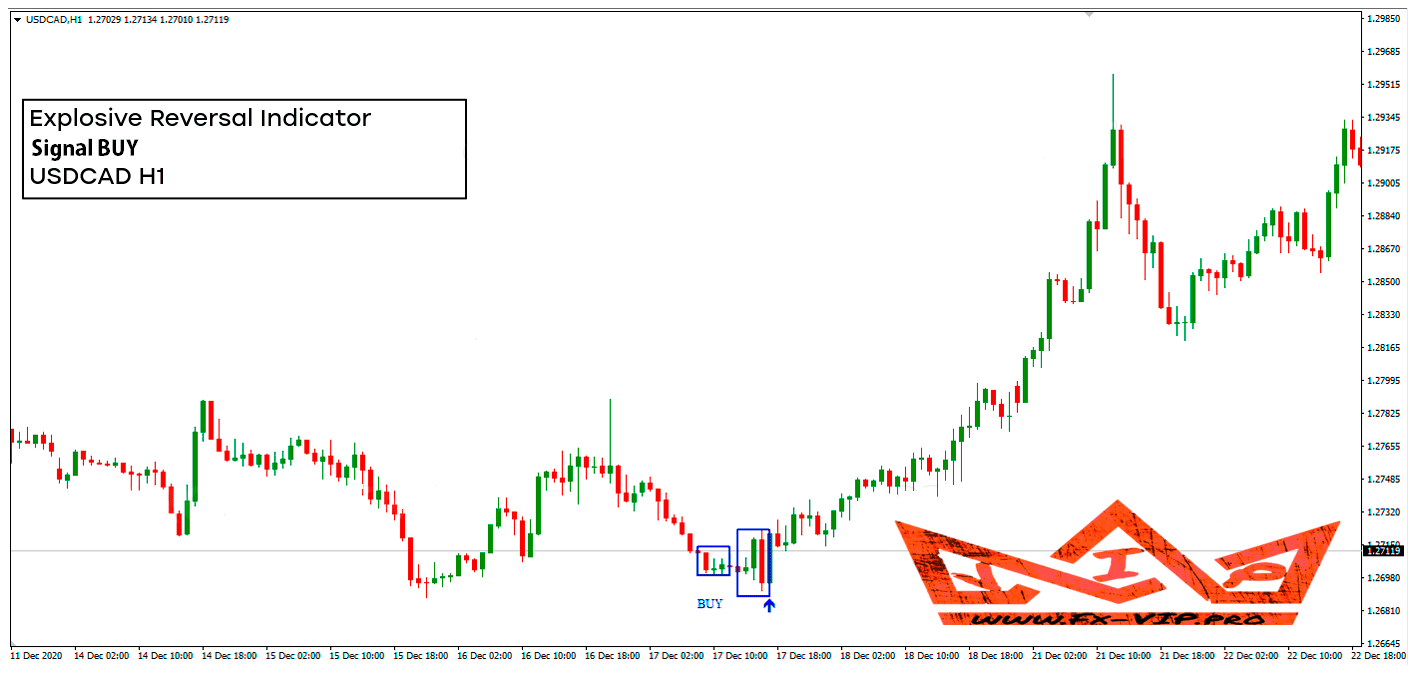

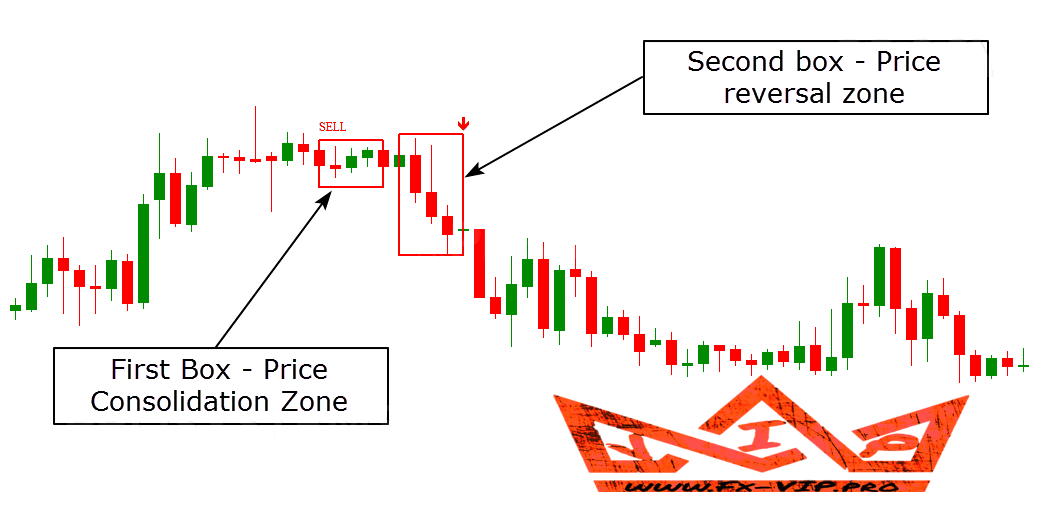

According to the developers, the indicator has a smart algorithm that combines Price Action and market timing strategies. The indicator does not redraw and does not lag. Explosive Reversal gives signals in the form of directional arrows “up” and “down”. In addition to pointers, the tool displays blue and red boxes on the chart, which show the range of price movement over a certain period of time.The borders of such boxes can be used as local support and resistance levels:

- A blue box appears when a buy signal is received

- A red box is formed when a sell signal appears.

The algorithm gives a signal at the moment of a trend change. If a downtrend changes to an uptrend, a blue arrow and a blue box appear on the chart. When a bullish trend turns into a bearish one, a red box appears on the chart combined with a red arrow.

TRADING RULES

The easiest way to trade is to make trades when the signal field and arrow appear. Entry into the market is carried out only in the direction of the signal. It is recommended to ignore trades against the trend.

BUY SIGNAL:

SELL SIGNAL:

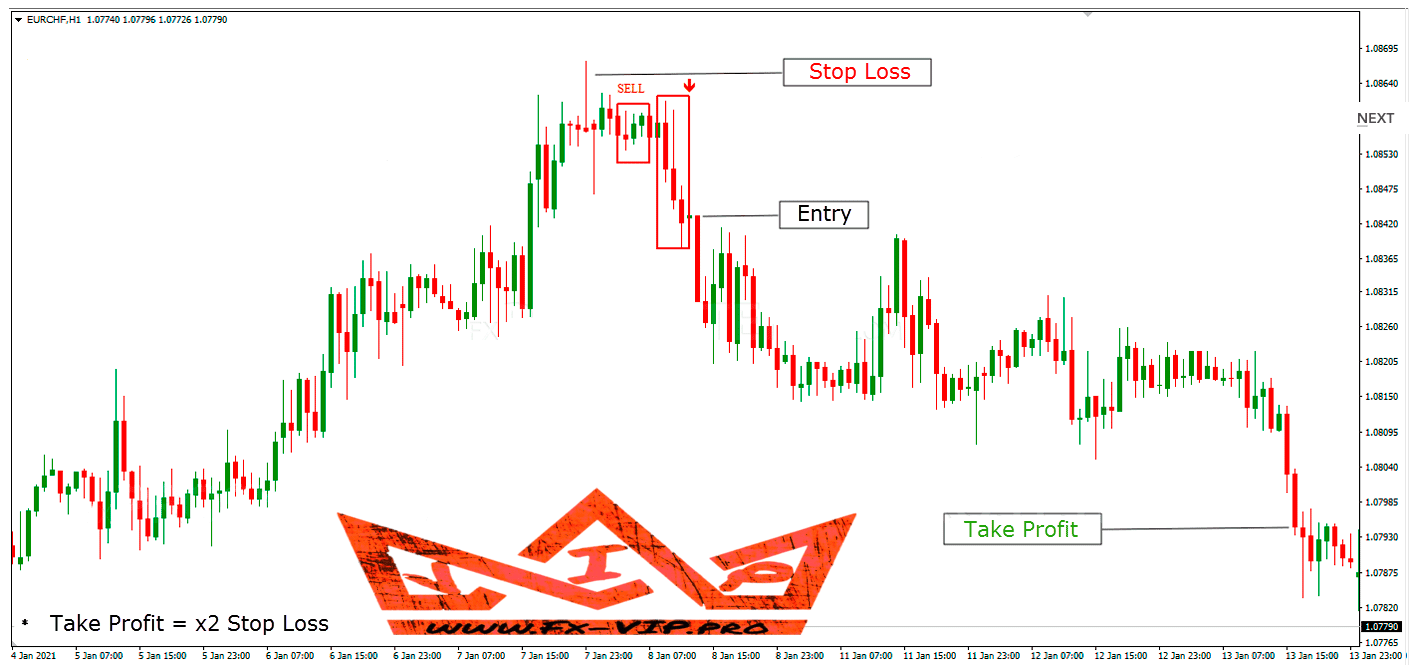

When trading Explosive Reversal, it is important to set a protective Stop Loss correctly .

- When making a deal to buy, the is placed beyond the lower border of the signal field

- When making a deal to sell, the must be placed beyond the upper border of the signal field

Take Profit must be at least 2x Stop Loss. If the market volatility is low and the take profit is too small, then it is better to skip the trade.

When trading with boxed signals, it often happens that the price hits the Stop Loss, and then reverses and continues to move in the direction of the trade. It is very simple to protect yourself from such an unpleasant incident – make a deal only at the moment of breaking through the extreme point of the second signal box on the price rollback. At the same time, a protective Stop Loss can be set a little further, setting it 3-5 points below/above the High or Low values, depending on the type of transaction.

In addition, Explosive Reversal can be used to quickly build local support and resistance lines. The upper and lower borders of the indicator boxes will play the role of levels. If we consider the signals of the algorithm against the background of a global trend, then its boxes can be used as an alternative to supply and demand zones.

The principle of trading according to this scheme is no different from regular trading by levels:

- If the price rebounded from the upper border of the box and turned down, then open a position for a fall.

- If the price rebounded from the lower border of the box and moved towards the bulls, then we open a deal to increase.

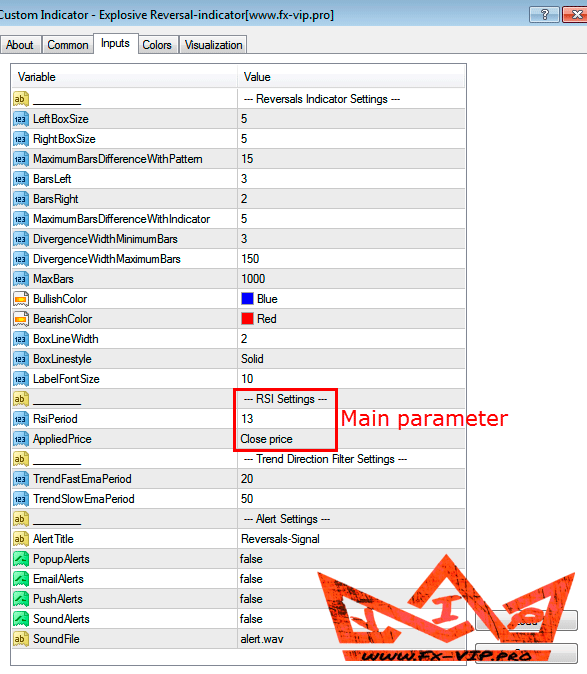

SETTING THE INDICATOR:

The indicator is based on the Relative Strength Index (RSI) algorithm, so the main input parameter that affects the quality of the signals will be the “Period” parameter. It is responsible for the number of bars that will be analyzed when searching for signals. The higher the period value, the less often the signals will appear. At the same time, their quality will noticeably increase, as the indicator will take into account more data. With a short period, the number of signals increases, but their quality deteriorates.

You can also make the necessary settings for the visual design of signals, activate / deactivate the alert function and the alert pop-up window. After setting up the indicator, you can start trading.

CONCLUSION:

To increase the number of profitable trades and eliminate false signals, analyze the chart of a higher timeframe. For example, when trading the H1, always look at the H4 chart. If on the older period the trend is steadily moving down, and on the younger period there is a signal to increase, then it is better to ignore such an entry into the market. If the general direction on both charts coincides and the price moves in the same direction, then you can open a deal.

Also do not forget that any indicator gives false signals, in order to weed them out and get more profitable trades, you should not use it alone, at least you need to take into account the support and resistance levels and not trade when the signal is at these levels, it’s also good if you you will use an additional confirming signal to enter a trade from another indicator or in conjunction with your trading strategy.

It is recommended to make the first 20-30 trades on a demo account in order to get used to working with the indicator and better understand its trading algorithm.

Reminder: As with every trading system, always remember that forex trading can be risky. Don’t trade with money that you can not afford to lose. It is always best to test EA’s first on demo accounts, or live accounts running low lotsize. You can always increase risk later!

aian

20/01/23

Working

RKarno

17/01/23

Indicator cannot be dragged and dropped onto the chart (all timeframes tried).