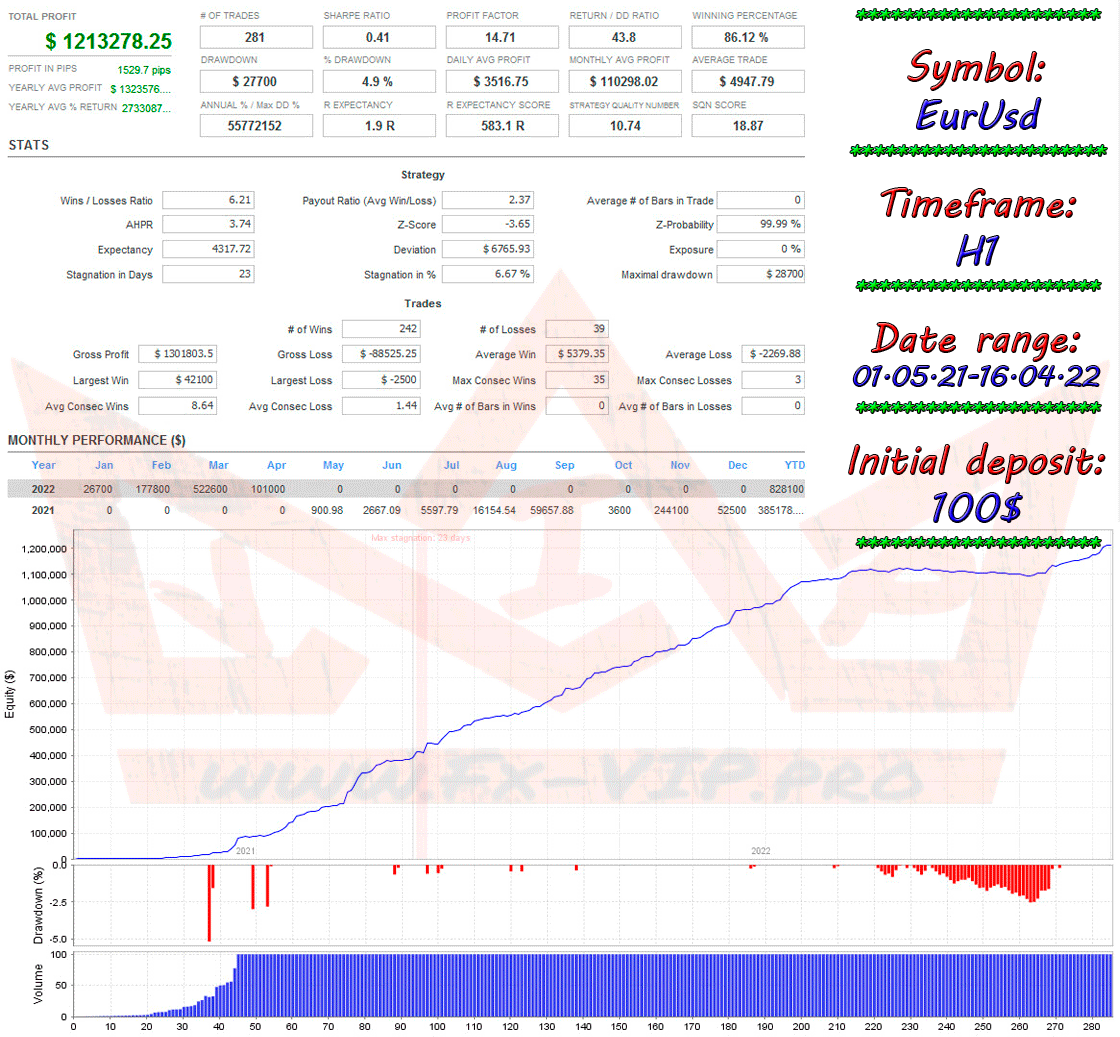

XMT-Scalper robot was created by programmer Capella and made a splash on the stock market in 2012, then the account was lost. Little is known about this advisor, but we found information that in its system the advisor uses two main indicators Moving Average and Bollinger Bands, the main timeframe M1, but as a result of backtesting, it was found out, oddly enough, the scalper brings more profit on higher timeframes , for example, on H1 he earned $ 1,213,278 in about a year !!!

Attention !!! Please read carefully the rules for installing the advisor, and install it correctly. Before publishing, we check everything and publish only those advisors that work on our accounts !!! At least at the time of this article’s publication.Also, please note that the name of the adviser has been changed, you can find the original name of the adviser in our telegram channel https://t.me/Fx_VIP

| Developer price | |

| Terminal | MT4 |

| Currency pair | USDJPY, EURUSD, EURJPY, GBPUSD, XAGUSD, XAUUSD |

| Timeframe | Any |

| Money management | At least 100 currency units |

| Recommended brokers | IC Markets , ALPARI |

| For advisor recommended to use VPS 24/5 | Zomro (most affordable Windows server only $ 2.75 per month) |

Strategy:

The strategy of XMT-Scalper is scalping on tic-basis, where the EA opens BUYSTOP or SELLSTOP orders when price breakouts occurs based on a specific indicator. The indicator is either two “Moving Averages”, “Bollinger Band” or “Envelopes” for the last 3 minutes. Any of the indicators can be used as decided from the external settings “UseIndicatorSwitch”.

For all indicators, “a channel” is calculated. And how wide this channel will be is decided by “VolatilityLimit” in points, which by default is calculated and adjusted dynamically, but also can be set to a fix value. If dynamic, it calculates this value as a multiplication of the average spread during the last 30 tics, and the value of the “VolatilityMultiplier”.

How much the breakout should be in percentage of the band-width is set by “VolatilityPercentageLimit” in percentage of the channel width.

Only one order is opened at a time, and an opened BUYSTOP / BUYSELL order is treated differently from an opened BUY / SELL orders as follows:

An open BUY-order is modified with a new StopLoss (SL) and TakeProfit (TP) if its current “TakeProfit” is less than the “current Ask price” + Commission” + “TakeProfit” + “AddPriceGap” AND “current Ask price” + “Commission” + “TakeProfit” + “AddPriceGap” – “existing TakeProfit” is larger than the “TrailingStart”.

An open SELL-order is in a similar way modified with a new SL and TP if its “current TakeProfit” is greater than “current Bid-price” – “Commission” + “TakeProfit” – “AddPriceGap” AND “current TakeProfit” – “current Bidprice” – “Commission” + “TakeProfit” – “AddPriceGap” is larger than the “TrailingStart”.

The SL for the modified BUY-order is changed to “current Bid-price” – “StopLoss” – “AddPriceGap”, and the TP to the “current Ask-price” + “Commission” + “TakeProfit” + “AddPriceGap”.

And for the modified SELL-order, the SL is changed to “current Ask-price” + “StopLoss” + “AddPriceGap”, and TP to “current Bid-price” – “Commission” – “TakeProfit” – “AddPriceGap”.

Open BUYSTOP and SELLSTOP orders are either modified or deleted. They are modified with new SL and TP as follows.

An open BUYSTOP order is modified if the “current Ask-price” + “StopLevel” + “AddPriceGap” is less than the “OrderOpenPrice” AND the “OrderOpenPrice” – “current Ask-price” + “StopLevel” + “AddPriceGap” is greater than “TrailingStart”.

An open SELLSTOP is modified with new SL and TP if “current Bid-price” – “StopLevel” – “AddPriceGap” is greater than “OrderOpenPrice“ AND “current Bid-price” – “StopLevel” – “AddPriceGap” – “OrderOpenPrice“ is greater than “TrailingStart”.

If the conditions are not met for the BUYSTOP or SELLSTOP order, then they are deleted.

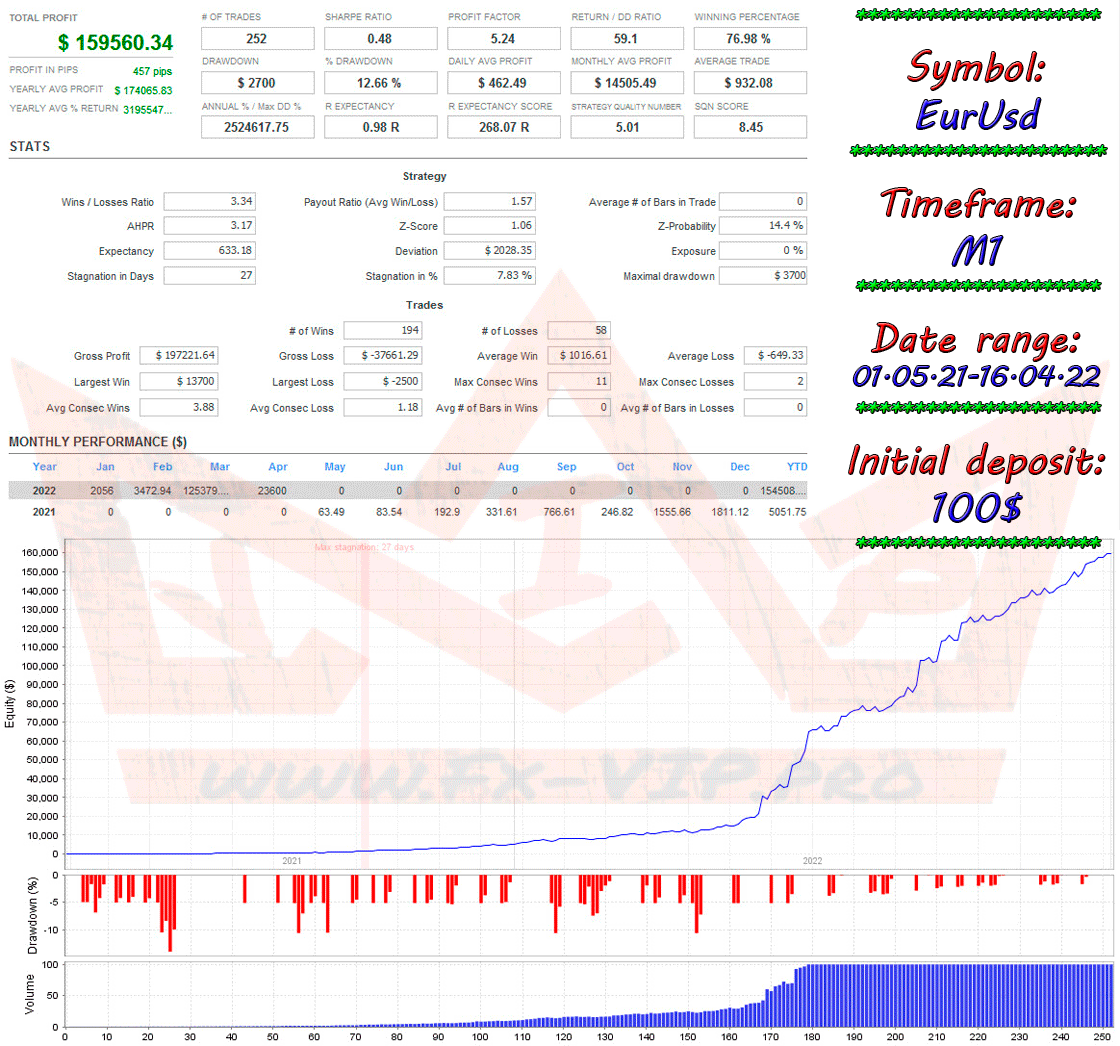

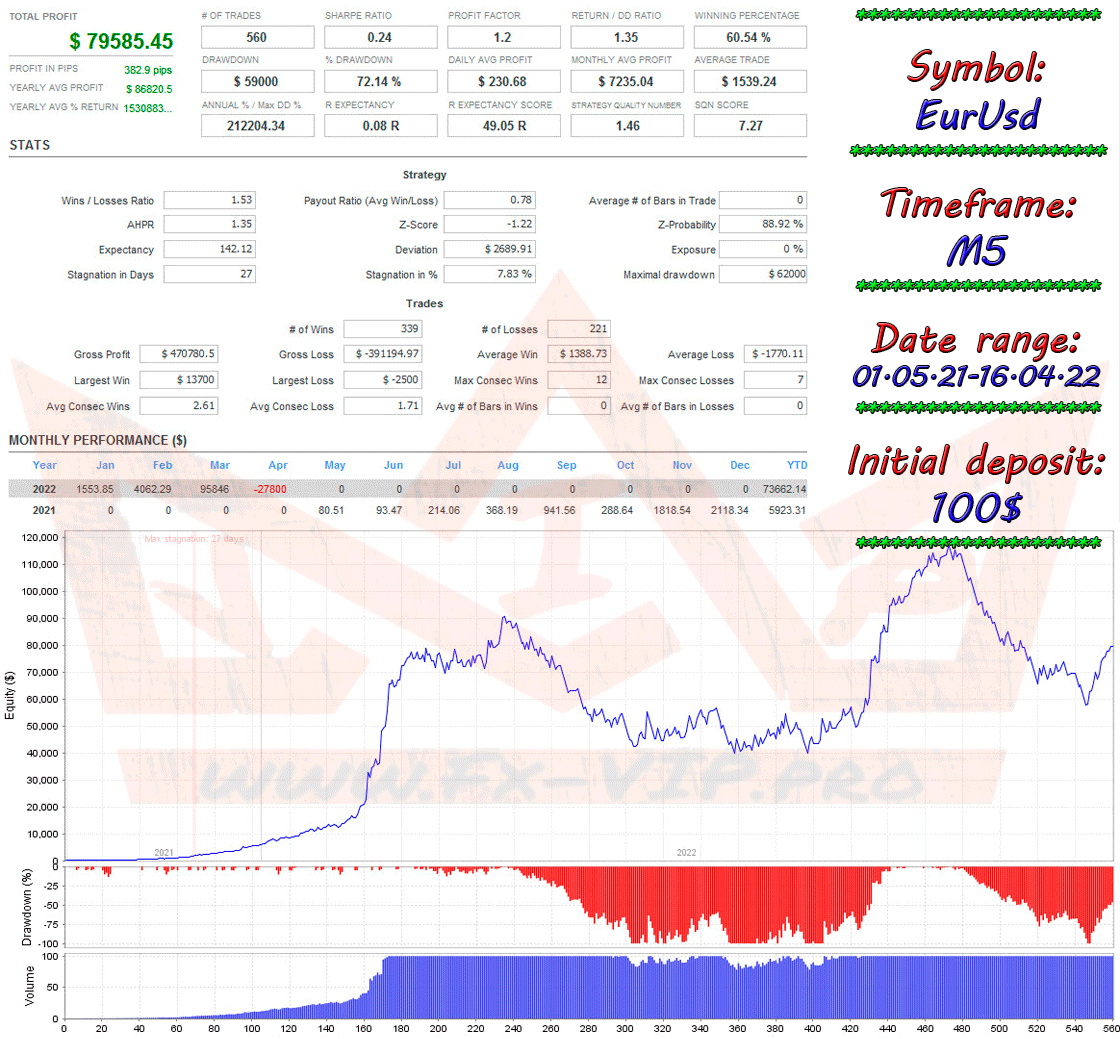

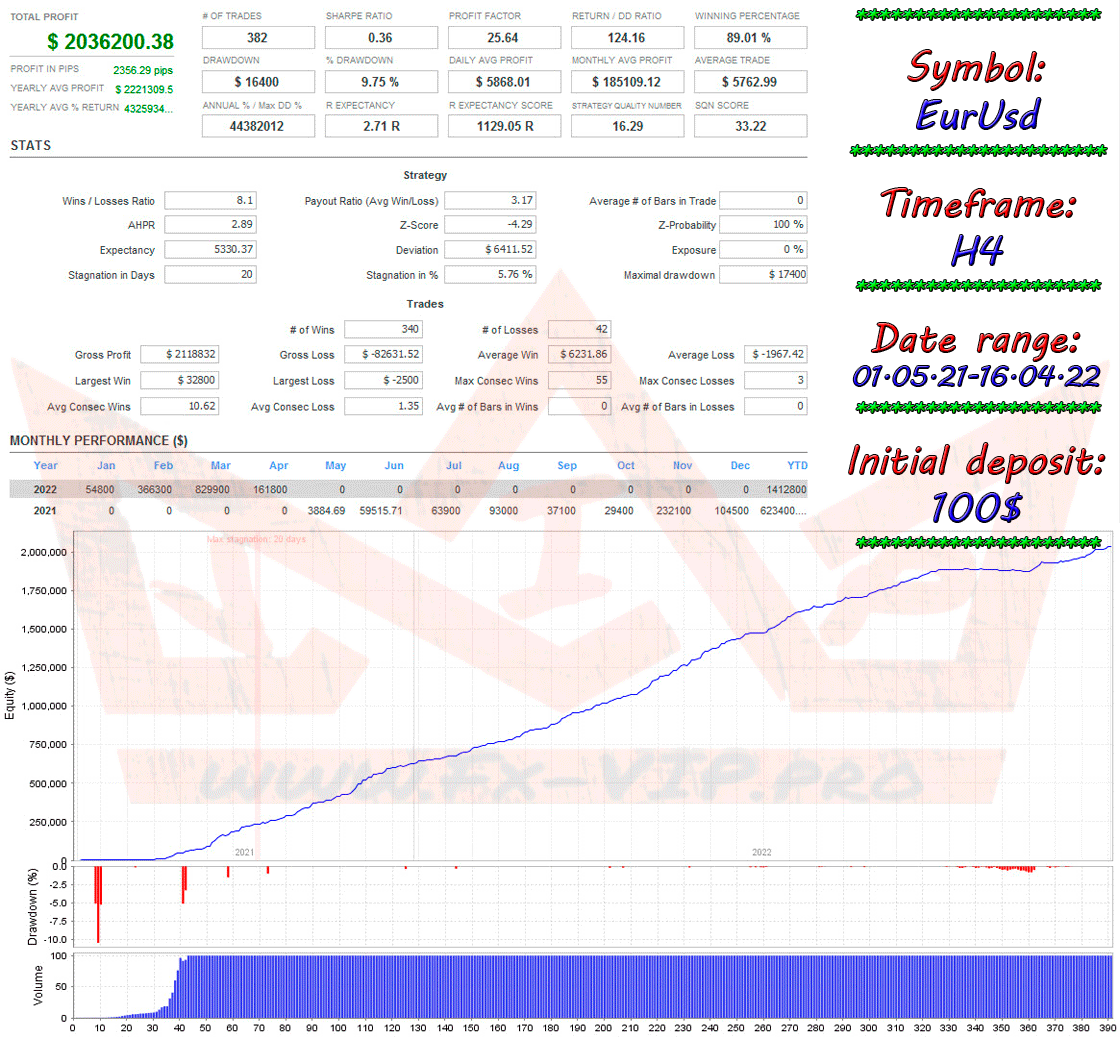

Back test:

As I wrote above, we found information that the adviser should be placed on the M1 timeframe, but after checking it in the strategy tester on different timeframes with the same settings, we can conclude that the higher the timeframe, the more the adviser makes a profit, so on the M1 timeframe for a year the adviser earned $159,560 and earned $5,494,027 on the D1 timeframe, which you will agree is much more, see more about the results of trading on each timeframe below

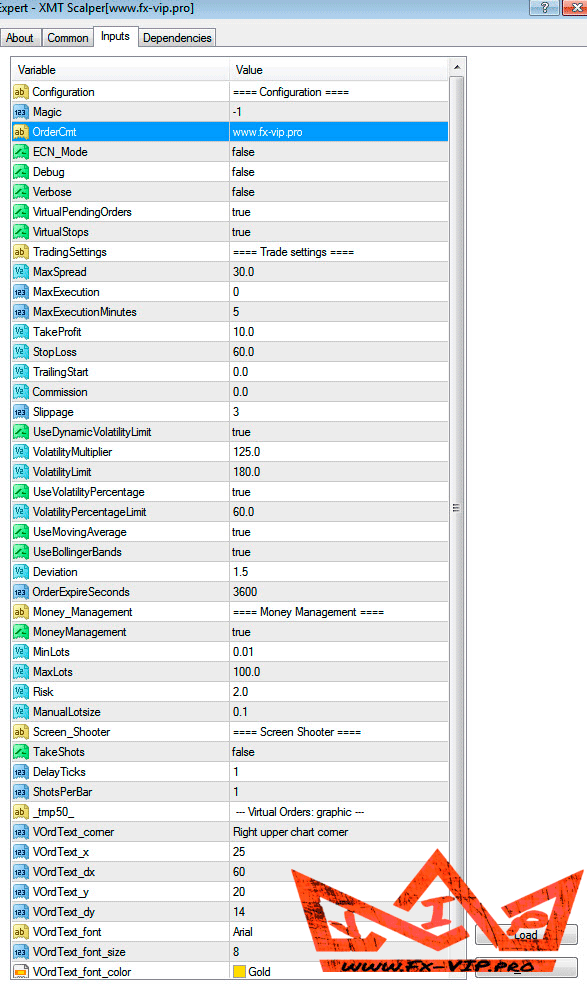

Settings:

Conclusion:

Guys, I want to tell you that it takes me one or two days, and sometimes more, to search for interesting material, I test a lot, read, sort through a bunch of useless EA until I find more or less suitable material.

So I found this adviser, checked it and it seemed to me that it would be interesting to test it in live trading, as it shows breathtaking results) while I was testing it, my friend found a fresh version of this adviser, but since the back tests were already done with the version 2.4.1 I decided not to redo it, but leave everything as it is, but later for myself I decided to test the more recent version 3.0 of this adviser, and I was surprised this version trades completely differently, and compared to the previous one on standard settings just drains the deposit!!!

Therefore, I will share with you two versions of this adviser, I recommend initially testing it on a demo account, since this adviser is some kind of mystery)))

Reminder: As with every trading system, always remember that forex trading can be risky. Don’t trade with money that you can not afford to lose. It is always best to test EA’s first on demo accounts, or live accounts running low lotsize. You can always increase risk later!

Albert Mbuyi

12/10/22

Je viens de télécharger, et j’essaie aussi cet EA qui m’a impressionné

billy

04/05/22

huge losses !!!! perfect on back test but desaster on a demo account

Fx-VIP.pro team

17/05/22

Thank you for sharing your opinion, it’s very important

Asteriks

01/05/22

I haven’t opened a single deal at all this week.

Samuel Sukmadi

01/05/22

For Version 2.4.1 standard setting not make any profit in demo account, today lost $ 10 tomorrow gain $ 12 always something like that. Please advise if you have set file and special setting for Version 2.4.1

Fx-VIP.pro team

01/05/22

thanks for sharing your opinion, unfortunately there is no installation file