Stable Pro EA uses an advanced SVG (Smart Variable Grid) algorithm that does not add grid trades at a fixed distance but analyzes market movements to determine grid positions, it also uses a “worst-case scenario” SL to prevent large equity drawdowns. There are several ways to set the “worst-case scenario” SL on each grid. From an SL based on the maximum historical drawdown to a much tighter SL to prevent large losses

Attention!!! Please read carefully the rules for installing the advisor, and install it correctly. Before publishing, we check everything and publish only those advisors that work on our accounts !!! At least at the time of this article’s publication. Also, please note that the name of the adviser has been changed, you can find the original name of the adviser in our telegram channel https://t.me/FX_VIP/2360

| Developer price | |

| Terminal | MT4 |

| Currency pair | AUDCAD, AUDNZD, NZDCAD |

| Timeframe | M5 |

| Money management | At least 200 currency units |

| Recommended brokers | IC Markets |

| For advisor recommended to use VPS 24/5 | Zomro (most affordable Windows server only $ 2.75 per month) |

Backtesting:

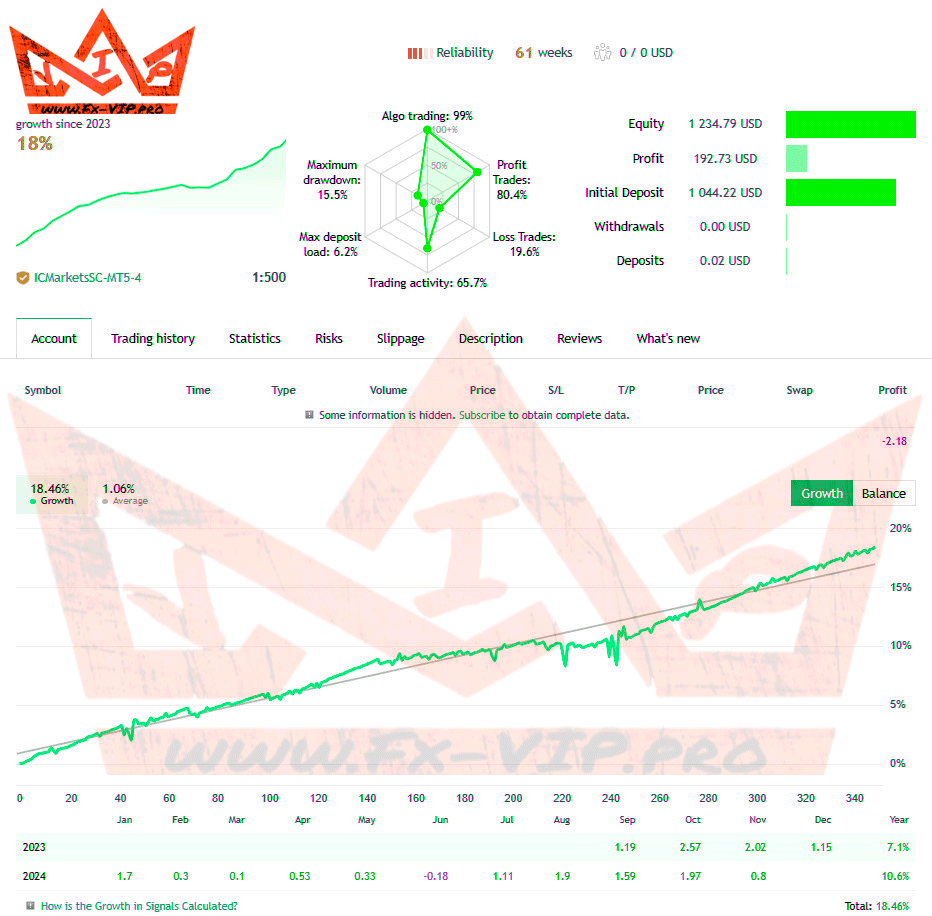

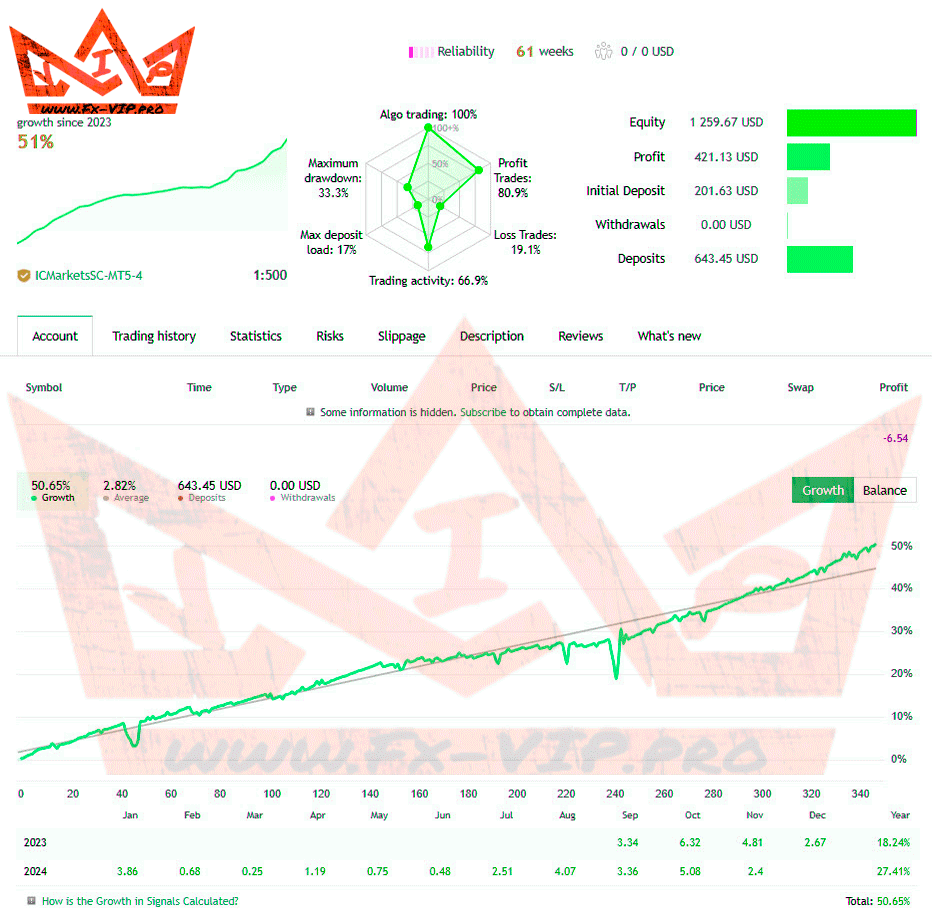

Backtesting was not conducted, as there is a signals on the accounts from the author, detailed statistics below

Settings:

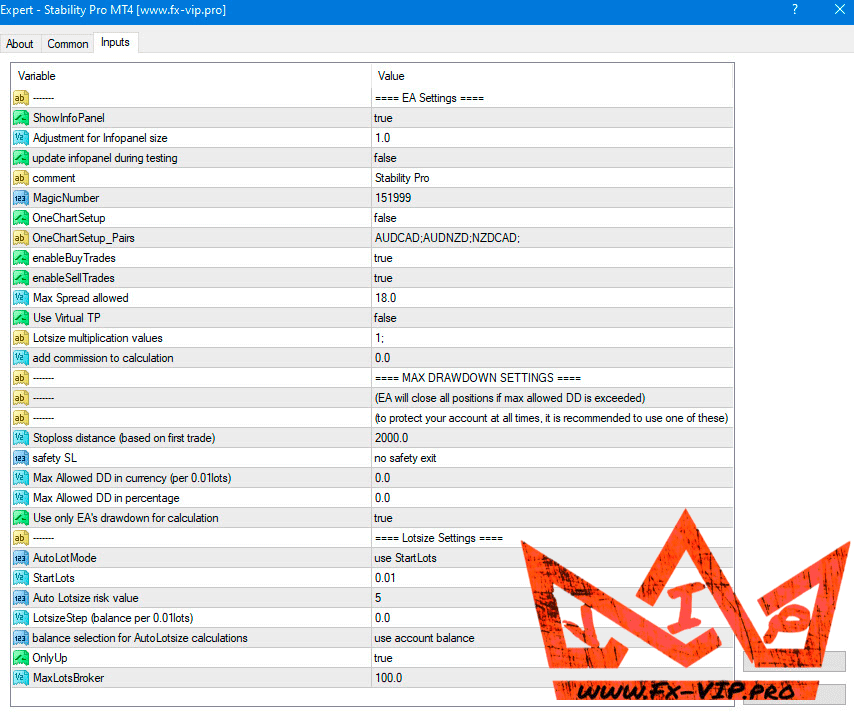

Description of parameters

- ShowInfoPanel: enables the information panel on the chart, showing trade data and profits/losses

- Adjustment for infopanel: to adjust the size of the infopanel for different screen resolutions

- update infopanel during backtests: to enable the infopanel in backtests (slower)

- comment: comment for the trades

- MagicNumber: the magicnumber used for all trades

- OneChartSetup: enable the OneChartSetup (run all pairs from a single chart)

- OneChartSetup_Pairs: which pairs to run

- enableBuyTrades: allow buy trades

- enableSellTrades: allow sell trades

- Max Spread Allowed: maximum spread allowed for the first trade

- use Virtual TP: disable the hardTP and exit on a virtual takeprofit

- stoploss distance: size of the stoploss for the trades (not really used for exiting since there is a max DD loss)

- Safety SL: Here you can set at which DD the EA should close to grid in loss, to prevent a bigger loss. The “historical Max DD” is based on the 2007-2023 period.

- Max Allowed DD in currency (per 0.01lots): if you selected the Safety SL to “manual max DD”, you can set the value here. It is based on 0.01lots and will automatically adjust to the lotsize running

- Max Allowed DD in %: here you can set the max allowed DD in % of the account balance or equity

- Use only EA’s drawdown for calculation: if you run multiple EA’s, it is recommended to enable this

- AutoLotMode: here you can choose how the EA must calculate the lotsize. “Startlots” means a fixed lotsize. the other options are based on the accountsize

- Startlots: set the fixed lotsize size

- Auto Lotsize Risk value: here you can set how aggressive the lotsize should be set. Value “5” is medium risk. Value “10” is very high risk. Value “1” is lowest risk.

- Balance selection for autolotsize calculations: use “balance” or “equity” for all lotsize calculations

- OnlyUp: prevents the lotsize from decreasing after a loss

- MaxLotsBroker: set the maximum allowed lotsize of your broker (to calculate the max lotsize for the first trade)

How to run the EA on your live account:

- First, add this URL to the “allowed URL’s” in the MT4 expert advisor settings -> https://www.worldtimeserver.com/

- Open a EURUSD M5 chart

- Attach the EA to the chart, and enable “onechartsetup” in the settings

- Choose your risk settings and safety settings

- Start!

Conclusion:

The advisor really looks stable and shows good results over a long period of time, two monitorings provided by the developer show that the advisor has an acceptable maximum drawdown even with a high risk level set in the advisor settings, and trading is conducted with a proven and reliable broker IC Markets , which also inspires confidence.

But I want to recommend from myself, although the developer claims that a minimum deposit of $ 200 is required, I would recommend at least $ 500, and preferably $ 1000, since the advisor uses the averaging method of positions, it is better to be on the safe side and have more free margin in case of drawdown in uncertain situations on the market.

Functionality tested, in build 1427 working.

Reminder: As with every trading system, always remember that forex trading can be risky. Don’t trade with money that you can not afford to lose. It is always best to test EA’s first on demo accounts, or live accounts running low lotsize. You can always increase risk later!