Adaptive EA is a new, unique approach to the forex market. The robot uses the grid principle as its main strategy, but the system adjusts the grid parameters and selects the required money management based on current market conditions and our settings to meet market requirements, this significantly increases profitability and improves the reliability of the strategy

Attention!!! Please read carefully the rules for installing the advisor, and install it correctly. Before publishing, we check everything and publish only those advisors that work on our accounts !!! At least at the time of this article’s publication.Also, please note that the name of the adviser has been changed, you can find the original name of the adviser in our telegram channel https://t.me/FX_VIP/2304

| Developer price | |

| Terminal | MT4 |

| Currency pair | USDCAD, EURUSD, AUDUSD, EURGBP, USDJPY |

| Timeframe | Any |

| Money management | Read below in the conclusion about the EA |

| Recommended brokers | IC Markets, NPBFX, ALPARI |

| For advisor recommended to use VPS 24/5 | Zomro (most affordable Windows server only $ 2.75 per month) |

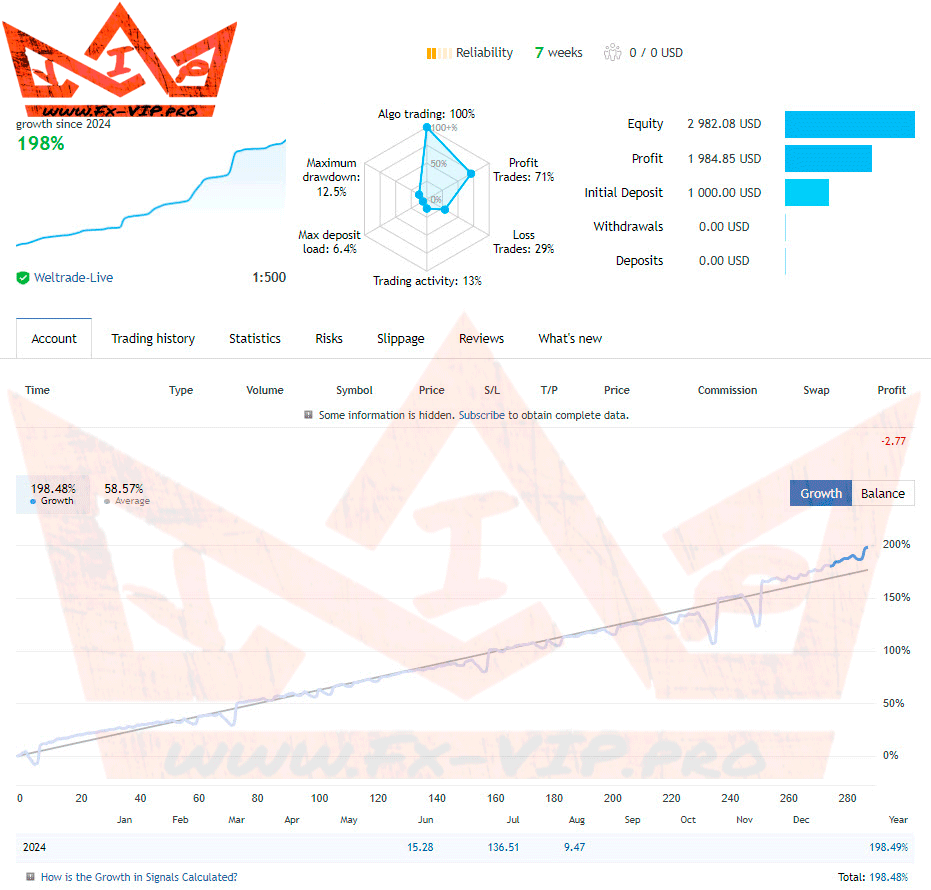

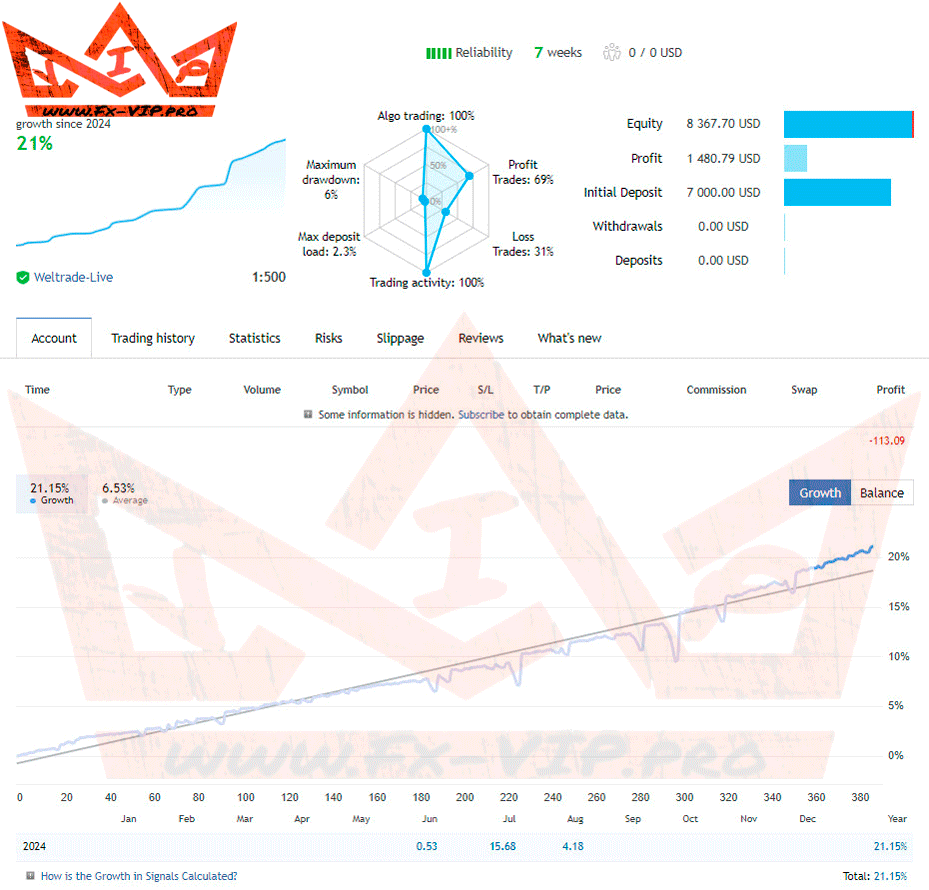

Backtesting:

Backtesting was not carried out as there are account signals from the author, detailed statistics of trade can be found below

Settings:

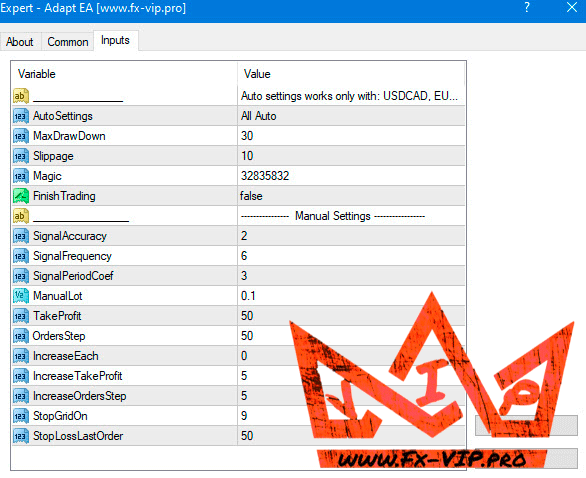

Description EA settings:

AutoSettings – This is the main operating mode of the EA. It has two parameters:

All Auto – This is a recommended mode, in which all calculations and settings are done

automatically for you, you just need to make sure that you have specified a suitable drawdown limit in

the MaxDrawDown parameter.

ATTENTION! This mode works exclusively with the following pairs:

USDCAD, EURUSD, AUDUSD, EURGBP, USDJPY. If you enable this mode, but install the EA on a different

pair, it will automatically switch to a manual mode – Manual Settings.

-Manual Settings – When using this mode, all automatic settings are disabled. The parameters of

the manual settings are enabled in the “Manual Settings” section at the bottom, and you also need to

specify the lot size in the ManualLot parameter. In this mode, the MaxDrawDown parameter does not

work. But you can specify a Stop Loss for the last order in the grid (in the StopLossLastOrder parameter),

which will also limit the drawdown if you wish. This mode allows you to trade on any currency pair.

MaxDrawDown – Here you need to specify in percentage the maximum drawdown that you are willing to

accept. This parameter is designed in such a way that it will not allow you to specify higher or lower

drawdown than the EA needs for stable operation.

Slippage – Maximum of the price slippage for buying or selling orders.

Magic – This is a unique number responsible for the identification of orders opened by the robot,

it must not match the magic numbers of other robots trading on your account.

FinishTrading – If you set this parameter to “True”, the robot will seek opportunities to “smoothly” stop

trading without losses. This means the robot will continue to open orders necessary for the strategy to

function correctly, but it will not initiate new orders (new baskets of orders). Thus, the robot will cease

trading precisely when it can do so without losses.

This is a section of manual settings for EA, which works ONLY if the Manual Settings mode is

enabled in the AutoSettings parameter.

ATTENTION! All parameters specified in pips are automatically converted from 4-digit to 5-digit format.

This means if you set a Take Profit value of 50 pips, for quotes in 4-digit format it will be 50 pips, but for

quotes in 5-digit format, this value will automatically convert to 500 pips — which represents the same

distance and value. Therefore, specify all values as if for 4-digit quotes, even if you are using 5-digit

prices.

SignalAccuracy – This parameter affects the accuracy of the signal, determining how much data volume

will be considered when forming the signal — the higher the value, the more data is taken into account.

The recommended range of values is from 1 to 10, but could be bigger.

SignalFrequency – This parameter affects the activation level of signals. The higher the value, the more

frequently orders will be opened. The recommended range of values is from 1 to 10.

SignalPeriodCoef – Coefficient that determines the time range during which the Market situation is

analyzed. You can only specify values in the range between 1 and 7. Higher or lower values will be equal

to the maximum allowed.

ManualLot – Here you can manually specify the lot size for the initial order.

TakeProfit – Take profit for each grid order. Specified in pips.

OrdersStep – Here you can specify the distance in pips between grid orders. It’s best if this value equals

the Take Profit parameter or is slightly less. If the value is greater than Take Profit, the orders will likely

close at a loss at some point.

IncreaseEach – Here you can specify how often the take profit (specified in the IncreaseTakeProfit

parameter) should increase after a certain number of orders, and how the step between grid orders

(specified in the IncreaseOrdersStep parameter) should also increase. For example, if you enter a value

of 2, it means the first two orders will have the standard Take Profit and Orders Step values. The next

two orders (3rd and 4th) will use the standard values specified in Take Profit and Orders Step, but with

the addition of the values specified in IncreaseTakeProfit and IncreaseOrdersStep parameters. The 5th

and 6th orders (the next 2) will have values similar to the 3rd and 4th orders, plus an additional increase

based on the IncreaseTakeProfit and IncreaseOrdersStep parameters. If the value is 0, there will be no

increase in take profit or step between orders.

IncreaseTakeProfit – Here you can specify how much to increase the take profit. Depends on the setting

of the IncreaseEach parameter.

IncreaseOrdersStep – Here you can specify how much to increase the distance between orders. Depends

on the setting of the IncreaseEach parameter.

StopGridOn – Here you can specify which grid order (by count) should no longer open, thereby

preventing further expansion of the grid.

StopLossLastOrder – Here you can specify in pips what the stop loss should be for the last order of the

grid (depending on the StopGridOn parameter) to limit the drawdown of the entire grid. This means that

when the last grid order is opened, it will be assigned a stop loss as specified in this parameter.

Additionally, the stop loss for all other orders in your basket will be set to this value to ensure all orders

close at the same point

Conclusion:

After installing the Adaptive EA robot and opening its settings, you can choose between using automatic

mode, where everything is configured for you, or manual mode, where you can use your own settings.

However, in this case, the robot will not adapt to the current Market conditions. The robot will trade on

that currency pair, on the chart of which you install it.

Automatic mode:

We have developed EA in such a way that the client can easily configure it in a couple of clicks,

and the robot will do everything by itself with the settings we have already prepared. In this mode, the

EA works only with the following currency pairs: USDCAD, EURUSD, AUDUSD, EURGBP, USDJPY. If you

install it on another currency pair, the automatic mode will switch to the manual settings mode – Manual

Settings.

The automatic mode is enabled by default, and the settings parameters should be as follows:

AutoSettings – must be enabled in All Auto mode.

MaxDrawDown – here you need to specify in percentages what part of deposit the EA will trade on the

currency pair you install it on. In case of Stop Loss, the drawdown will be limited by the specified level

of deposit. By default, the risk is 30%.

Manual mode:

AutoSettings – switch to Manual Settings mode in order to configure all the parameters manually (entry

point, Take Profit, etc.). Please note that in this case, the robot will not automatically adapt to the

current Market conditions.

Risks:

We recommend specifying the risk of 10-20% for each pair in case of trading 4-5 pairs. For trading 2-3

pairs, the risk can be 15-30%. In the case of trading one pair, the recommended risk is 25-40%.

Requirements for trading:

The minimum deposit for trading using lot of 0.01:

USDCAD – $1070

EURUSD – $1300

AUDUSD – $750

EURGBP – $700

USDJPY – $830

Recommended leverage:

Trading 3-5 currency pairs:

If the risk is 100% for all the pairs, use a leverage of 1:500 or higher – in any case, higher is always

better!

Using the risk of 40%, the leverage can be 1:200.

Using the risk of 20%, the leverage can be 1:100.

Using the risk of 10%, the leverage can be 1:50.

Using the risk of 5%, the leverage can be 1:25.

Functionality tested, in build 1420 working.

Reminder: As with every trading system, always remember that forex trading can be risky. Don’t trade with money that you can not afford to lose. It is always best to test EA’s first on demo accounts, or live accounts running low lotsize. You can always increase risk later!

kosmebelloni@gmail.com

12/08/24

hello good afternoon.

where should I configure the compilation